By Dan Byrne

Global resources suffer a cost of around $1.6 trillion per year due to money laundering efforts across the world, according to the UN.

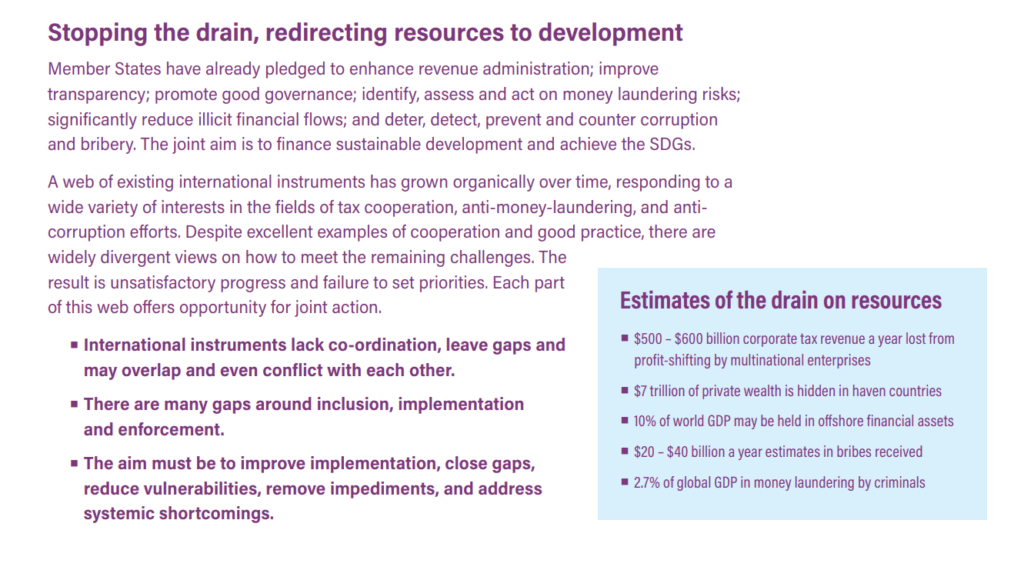

The Financial Accountability Transparency & Integrity panel (FACTI) – a UN-affiliated body aimed at achieving sustainable development through combatting financial crime – estimates a figure of 2.7% of global GDP being lost annually due to money laundering by criminals.

The FACTI interim report says $7 trillion of the world’s wealth is likely held in ‘haven countries’, and that between $20-40 billion in bribes is received by individuals annually, the report suggests.

The findings were released in the immediate aftermath of the FinCEN files leak – a huge collection of data obtained from the US Treasury by Buzzfeed, which showed trails of dirty money transfers across the world – worth billions of dollars – and how authorities did little to stop it despite knowing it was happening.

FACTI has said that the international instruments to combat financial crimes such as this “lack co-ordination, leave gaps, and may overlap and even conflict with each other.”

It stressed that an adequate financial integrity system links authorities in all nations – developed and developing, large and small – and that any weak link in that system undermines it in its entirety, since resources can be drained through the weak spots, (see UN graphic below).

The FinCEN files, with large amounts of data stretching over an 18-year period, implicated wrongdoings in more than 170 countries worldwide.

However, some notable jurisdictions which are alleged to have seen large-scale dirty money transfers include Russia, Malta, Malaysia, Hong Kong, the UK and USA.

The UK in particular – home of one of the world’s leading financial centres – has been labelled a ‘high risk jurisdiction’ due to its prominence in the file leak. It has also been criticised for the ease at which its corporate law allows criminals to launder money through British-based shell companies.

FACTI has called the issue of financial integrity a “global problem that needs global solutions, while taking into account specific country contexts.”

Although over 200 jurisdictions are implementing key recommendations from the Financial Action Task Force (FATF), the governments of ‘haven countries’ have little incentive to do so, owing to the profits their banks can make in allowing dirty money to funnel through, FACTI said.

They have highlighted beneficial ownership information as a key to combatting the problem, however they deem the sharing of this information across borders as “too difficult” – instead calling on major financial centres in developed countries to take more responsibility.

Share this on:

Follow us on: