By Dan Byrne for AMLi

A top AML expert has questioned the recent announcement by the US Department of Justice that cryptocurrencies post a significant threat to American national security.

Pawel Kuskowski, CEO of international blockchain analytics firm Coinfirm, told AMLi that, “there are a number of reports including RUSI reports which indicate that terrorism financing is not a greater risk in the crypto sector.”

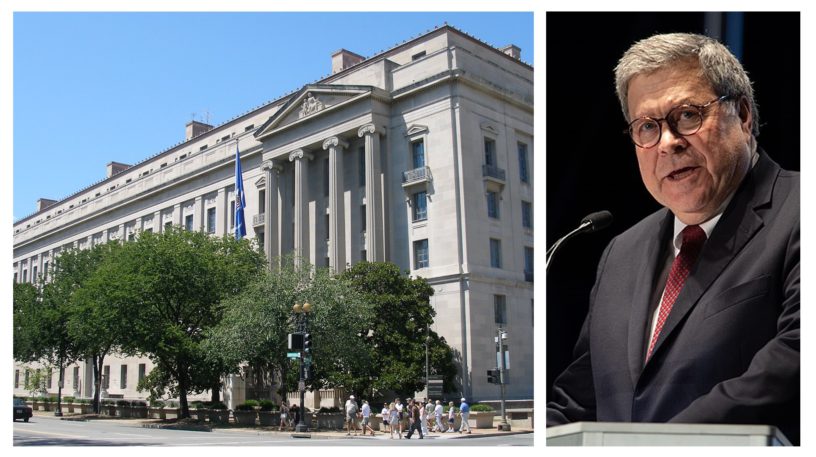

He spoke following recent comments by US attorney general William Barr, stressing that ensuring the safety of cryptocurrencies from financial crime is “vitally important” for safeguarding the national security of the US and its allies.

Barr, alongside the US department of justice, launched a new report in October; Cryptocurrency: A Digital Framework, which highlighted the threat of cryptos being used as avenues for financing terrorism.

The report warned that the current use of cryptocurrencies by terrorists “may represent the first raindrops of an upcoming storm.”

However, Kuskowski has maintained that the risk of terrorism financing in traditional areas of finance was just as present – pushing back against the DoJ and other authorities for lack of action.

“We do not see the DoJ or Interpol actively working with the industry to remove any such risky addresses from the operation,” he said.

“If this was done, nobody on the market would touch funds tainted by terrorism. We know for a fact that traceability is higher in crypto than in traditional finance.”

Cryptocurrency use has been subject to repeated international scrutiny for its perceived lack of comparative safeguards against financial crime that would be found in more traditional finance areas.

The DoJ’s report comes at a time when digital assets are becoming more popular amid the frequent COVID-19 lockdowns and the growing need to do business online.

Assets such as bitcoin are seen as tools that make it easier to transfer vast sums of money with less detection from governments and financial watchdogs.

The report discussed these transfers on a transcontinental scale and warned that massive criminal empires such as drug cartels would be allowed to “cover their financial footprints and enjoy the benefits of their illegitimate earnings.”

It also said these laundered funds were frequently transferred via channels that avoided current anti-money laundering laws and did not comply with important related protocols, such as know-your-customer (KYC) guidelines.

It singled out a commonly flagged issue plaguing AML efforts worldwide: differing rules and diligence in applying them can “create challenges for international law enforcement and regulatory agencies operating in this space.”

The DoJ has called on all stakeholders – including regulators, cryptocurrency users and corporates – to take steps to ensure cryptocurrencies are not used as “a platform for illegality.”

As attention turns to their increased prevalence in business worldwide, politicians and financial crime watchdogs are strengthening their efforts to ensure government control of the market, or at least government immunity from being undermined by private currencies.

Last week, European lawmakers called for tougher action on regulating private cryptocurrencies like bitcoin, as well as Libra – Facebook’s own cryptocurrency which is to be launched in the near future.

MEPs stressed the need for an official European digital currency, which would offer the same flexibility to users, but which would be publicly owned and regulated by the ECB instead of private entities.

There have been some calls to ban cryptocurrencies outright in Europe, but in the US, acting Assistant Attorney General and Task Force member Brian C. Rabbitt advised that the DoJ is “committed to supporting the advancement of legitimate cryptocurrency technologies and uses.”

Share this on:

Follow us on: