By AMLi Correspondent

The Frankfurt office of the VAB Association of Foreign Banks in Germany was searched last week by Cologne prosecutors as part of a probe into the so-called Cum-Ex tax affair.

VAB Managing Director Andreas Prechtel confirmed the raid and said that “prosecutor’s allegations were not directed against the VAB, its organs or employees.” The lobby group — which has around 200 member institutions — is cooperating with authorities and has provided “all relevant documents,” he added.

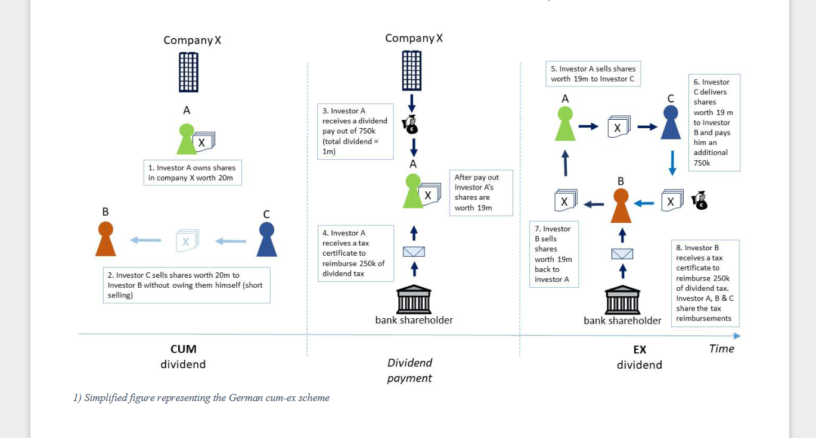

The scheme, known as cum-ex, involved a network of traders, hedge funds, asset managers and banks claiming multiple refunds on dividend withholding tax that was only paid once, or not at all, through a complex series of trades.

The scheme, since deemed illegal by Germany’s Federal Court of Justice, worked by buying and selling huge volumes of shares in a co-ordinated circuit, at key times around the date companies paid out dividends.

The aim was to create confusion as to who was owed a refund on dividend withholding tax, allowing it to be claimed multiple times, costing European tax authorities billions of euro over two decades.