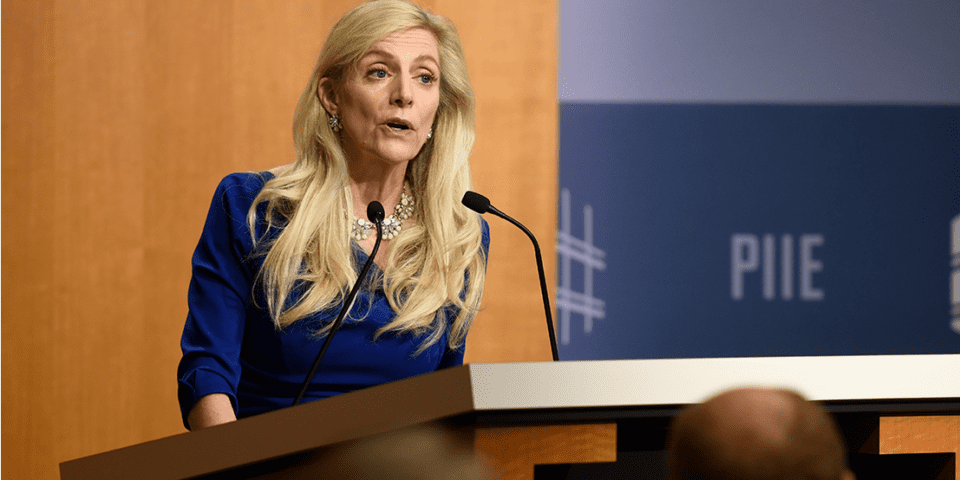

Federal Reserve vice-chair Lael Brainard wants crypto currencies regulated after the sector exposed “serious vulnerabilities” over the last few months.

Brainard told a Bank of England conference in London Friday she believed crypto is not yet “so large or so interconnected” with traditional finance to pose a systemic risk to the banking.

“While touted as a fundamental break from traditional finance, the crypto financial system turns out to be susceptible to the same risks that are all too familiar from traditional finance, such as leverage, settlement, opacity, and maturity and liquidity transformation,” Brainard said.

In addition, Brainard’s address took aim at cryptocurrency companies that might mirror the activities of traditional finance without equivalent regulatory standards.

She noted that many crypto trading and lending platforms had no comparable regulation but “also combine activities that are required to be separated in traditional financial markets”.

“It is important to address non-compliance and any gaps that may exist,” she said.

She added: “As we work to future-proof our financial stability agenda, it is important to ensure the regulatory perimeter encompasses crypto finance.”

Over the last few months the crypto sector has seens several key players including crypto hedge fund Three Arrows come apart in a plunging market.

Tokens such as bitcoin and ether have lost roughly 70 per cent of their value.

Against this background Brainard questioned the pitch that cryptocurrencies act as a hedge against inflation.

“Contrary to claims that crypto assets are a hedge to inflation or an uncorrelated asset class, crypto assets have plummeted in value and have proven to be highly correlated with riskier equities and with risk appetite more generally,” she said.

She also spoke about the the stablecoin industry – which are supposed to track real-world currencies, and provide crypto market stability by offering a quick route for traders to change digital tokens for dollars.

“It is vital that stablecoins that purport to be redeemable at par in fiat currency on demand are subject to the types of prudential regulation that limit the risk of runs,” she added.

The once-popular stablecoin terraUSD has collapsed along with sister token luna, wiping out billions of dollars for investors.

“The terra crash reminds us how quickly an asset that purports to maintain a stable value relative to fiat currency can become subject to a run. The collapse of Terra and the previous failures of several other unbacked algorithmic stablecoins are reminiscent of classic runs throughout history.”

Referring to to tether — the industry’s largest stablecoin — and the significant outflow pressure the stablecoin provider experienced in May, Brainard said: “As highlighted by large recent outflow from the largest stablecoin, stablecoins pegged to fiat currency are highly vulnerable to runs,” she added.