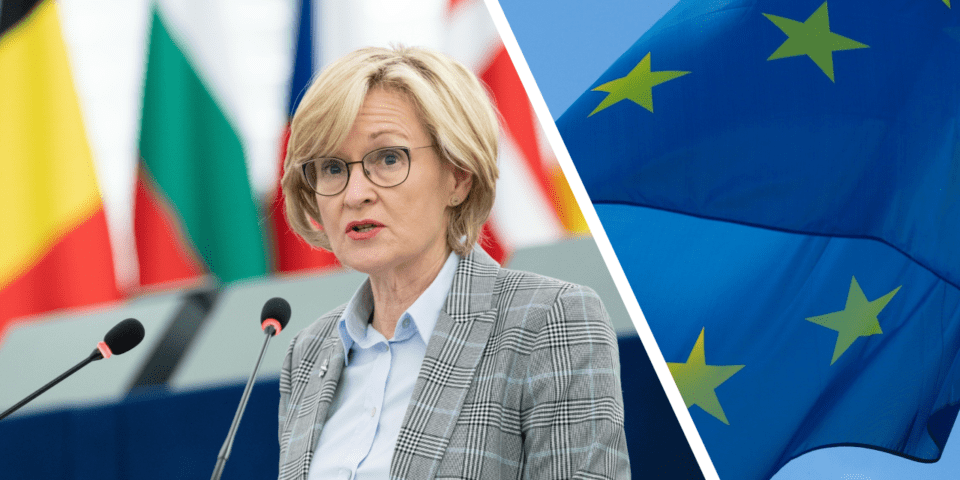

This is the full script of the speech given this week by EU financial services Commissioner Mairead McGuinness at the Banque de France on the tokenisation of finance:

Merci beaucoup, bonjour à tous. J’aurais aimé être à Paris avec vous aujourd’hui, mais je suis à Bruxelles.

So firstly good afternoon everyone.

Thank you, François, for both the invitation and particularly for your wide-ranging opening remarks.

You talked about trust in the very beginning in the very beginning of your speech, which I think is so, so important.

And I think your linking to the architecture at the end of your speech was very, very correct and well said.

One thing that I really want to emphasise, which you already have, is that regulation and innovation are not in conflict.

Because regulation and innovation should work hand in glove.

And if we take the broad example of the single market.

By legislating and regulating at a European level, we enable a new business to start up in a Member State but easily expand to another; or indeed a financial institution authorised in one country to finance a company based in another.

So rules and regulations underpin a single market that offers both opportunity and security to consumers and businesses.

In contrast, the area of tokenisation has often been described, and you will know this, as a Wild West – a lawless place, full of risks and dangers.

And I have to say that those lawless days are coming to a close.

By bringing in rules we want to guard against those risks and dangers – while allowing us to harness the possible benefits.

So today I want to address what tokenisation might mean for the financial system; how we are responding to these changes with regulation; and how the public sector, and in particular central banks, might complement what we are seeing in the private sector.

So firstly the challenges and opportunities.

Tokenisation started as a challenge to the existing financial system.

It emerged from a desire to disrupt.

It was about bypassing the traditional financial system, seen by some as stacked against the man on the street.

And I think it is no coincidence that the Bitcoin network started operating in 2009, against the backdrop, if you like, of the financial crisis, and the distrust of financial institutions that resulted from that crisis.

It is also perhaps no surprise that crypto markets have exploded since.

Crypto markets, as you know, are extremely volatile – but overall they have expanded to a global market capitalisation of around 1 trillion euro.

And behind all of this is blockchain technology.

This technology does have potential.

It cuts out the middleman – removing the need for centralised processes and intermediaries.

It can make transactions more efficient and transparent, by recording key information in an unchangeable format, making it accessible to all market participants.

And this could make payments cheaper, faster and safer.

This technology could also unlock the billions of euros and dollars currently used to cover credit or settlement risk in the financial system.

But these potential benefits cannot emerge in a Wild West scenario.

Without regulation, crypto poses big risks for the system, for our financial system.

Crypto markets are growing in size and popularity, so we need to think about their systemic risk.

In February this year, the Financial Stability Board warned that crypto markets have the potential to grow into a threat to global financial stability.

And we need to take those warnings very seriously.

And even if crypto markets do not yet present systemic risks, they already present many other risks.

Earlier this year, a number of larger crypto projects collapsed – including supposedly stable stablecoins – laying bare the lack of supervision.

We know that consumers risk buying into unsuitable products, because they are often lured in by a false promise of value going up and up and up.

Investors risk losing money because of crypto’s volatility, and we know many have.

They can also lose through deception and/or fraud.

The Financial Times recently reported about the boom of crypto fraud alongside the boom of crypto markets during the pandemic.

And they reported that one of the best ways for a victim to recover at least some of their losses is – perhaps ironically – through their bank.

Banks are regulated financial institutions, and so are subject to prudential rules as well as rules to protect their customers.

Crypto also poses risks relating to money laundering and sanctions circumvention.

This year, the US Treasury’s Office of Foreign Assets Control has sanctioned two currency mixers.

Because certain state-sponsored hacking groups which help their governments evade sanctions have been using these mixers to launder money stolen in cyber-attacks.

And all of that means that there is a clear and urgent need to regulate and supervise crypto markets.

So the Commission is doing a lot of work to regulate crypto markets and allow them to develop on a sound basis.

One of the first steps we took was to create a pilot regime, which François you referred to, and this is for securities trading and settlement on distributed ledger technology, or DLT.

So I’m happy this pilot has entered into force and can be used from March of next year.

This is all about allowing innovation and experimentation but within a safe environment where the citizen is protected.

The Distributed Ledger Technology, DLT, pilot aims to develop secondary markets for ‘tokenised’ financial instruments, where market participants can experiment with trading, clearing and settling securities using DLT.

This pilot aims to identify ways to improve efficiency.

It could make it possible to merge trade and post-trade processes currently being provided by different market infrastructures.

Financial firms will be able to apply to their national supervisor to get permission to run on DLT market infrastructures, and to get temporary exemptions from specific EU trading and post-trading rules.

If granted, they could then trade and settle a broad range of securities on DLT, subject to certain limits.

And I would encourage all companies and supervisors to make use of the opportunities in this pilot to learn and to experiment – as you’ve already said, to learn by doing.

It’s an example of this idea that good regulation that enables innovation.

And it is a demonstration of how the EU is supporting efficiency on financial markets – something we want to encourage as we develop the Capital Markets Union.

The second major step we’ve taken is the proposal for a regulation on markets in crypto-assets – or ‘MiCA’.

The European Parliament and Council reached political agreement on this regulation in June – again at the end of the French Presidency of the Council of the European Union.

So a big appreciation to my French colleagues for this substantial volume of work.

The whole thinking behind MiCA is to support a crypto-asset market and allow innovation, but to do so on a sound basis and addressing the risks I’ve already mentioned.

So we want to root out bad actors. We want to provide the consumer and investor protection that just doesn’t exist in this area yet, and to set rules for crypto-asset service providers.

MiCA will bring crypto markets into the regulated space.

And under MiCA, the crypto-asset service providers will be subject to both prudential requirements and rules of conduct.

It will also require actors in the crypto-asset market to disclose information on the environmental and climate footprint of crypto-assets.

Crypto markets will be supervised by regulators that will be able to intervene if there is any evidence of market abuse or activities that may lead to financial instability.

So this regulation would mitigate against the kind of turbulence we saw earlier this year for so-called ‘stablecoins’.

It sets out strict requirements on establishment, authorisation and reserve management for any tokens which refer to an official currency or a basket of assets.

That includes EU direct supervision for these so called ‘E money tokens’ and asset-referenced tokens that are systemically important.

Central banks and the ECB, as well as the EBA and ESMA, will have important roles to play in this new regime.

We have also extended the Transfer of Funds Regulation to the virtual and crypto space.

Just before the summer, the co-legislators reached agreement on this Regulation – setting new rules for transparency of crypto transfers.

And this will bring much-needed transparency to these transfers, helping address a new vulnerability in our fight against money laundering.

These rules will enter into force at the same time as the MiCA Regulation.

While addressing risks in the crypto-asset market, MiCA and the Transfer of Funds Regulation will give legal certainty to market participants and promote innovation in the single market, within a framework of clear rules.

Service providers will need to be authorised in the European Union.

But once they have that authorisation in one Member State, they will benefit from our financial passporting system to offer their services throughout the EU.

And indeed the EU is among the first in the world to design such a comprehensive regulatory regime for crypto-assets.

And I do believe this regulation will allow crypto markets to develop on a sound basis.

We hope that European firms will take advantage of both these pieces of work, the DLT pilot and the MiCA regulation.

While it is noteworthy and good that Europe is a trailblazer on crypto regulation, it is also important to recall that crypto markets are global markets.

And that means that we need international coordination.

And that goes too for decentralised finance.

Decentralised finance is all about providing financial services without a central intermediary like a bank or an exchange.

And all of this challenges both international standards and EU rules that tend to be based around entities.

In fact, it challenges some of the fundamental aspects of the financial system as it currently exists.

And here in the Commission we are monitoring the developments and risks in this fast-moving area very closely.

Central banks, and indeed we have heard already, have also not been idle throughout these many changes.

One of the main roles of central banks is, of course, to issue physical cash and oversee the monetary system.

So central banks are carefully watching and analysing the consequences of money and transactions moving online.

And central banks are centre stage when it comes to Central Bank Digital Currencies.

And the Atlantic Council reports that over 100 countries are exploring a Central Bank Digital Currency.

Just ten have fully launched a digital currency – including Nigeria, one of Africa’s fintech powerhouses.

And indeed I know that Banque de France is very active in this area.

You have worked on cross-border projects with Switzerland and Singapore, and you are also involved in the digital euro project.

So let me just say a little about the digital euro.

We in the Commission are working closely with the European Central Bank on this project.

In a digital world, the digital euro would provide a public money alternative to private means of payment – and as a complement to cash.

It would offer additional payment options to people and businesses across Europe.

New options for online payments, offline payments, peer-to-peer payments, and many more.

And it would be a complement – not a substitute – for private initiatives.

The digital euro could be significant for people and businesses.

And we need to thoroughly consider the possible consequences and of course to consult as widely as possible.

And this all led the Commission to conduct a targeted public consultation, in addition to the consultation work already undertaken by the ECB in 2020.

We got a lot of responses to that call from citizens and businesses.

There are many important questions to consider, and this will all be informing our progress on this project.

I think it is fair to say that the digital euro project was met with a lot of interest and support, although some financial institutions were asking about the potential impact of a digital euro on their business model.

So some examples that were raised.

Several respondents pointed to the risk of disintermediation of banks and financial stability risks.

There are big risks that we need to guard against.

And we should also look at the role of private market participants in the distribution of the digital euro.

Some of the respondents felt that the digital euro should focus on complementing what’s already on offer by the private sector.

While others saw the potential for new innovative features, like machine-to-machine payments or programmable payment functionalities.

All respondents concurred that people-to-people and offline payments would add the most value for users, mirroring cash payments.

Privacy was a big concern for citizens who responded to our consultation.

So we would need to provide privacy, while balancing that with the need to address the risk of money laundering.

And we should also determine whether the digital euro should be granted legal tender status – like euro cash – or not.

So in the Commission, we plan to propose legislation for a possible digital euro in 2023.

And this will lay down the principles for the digital euro.

And the European Parliament and the Council will then have the opportunity to debate and amend our proposal.

And this legislation would be a necessary step before the potential issuance of a digital euro by the ECB.

And I know Christine will speak about the ECB’s perspective on the digital euro project later today.

Earlier I mentioned that over 100 countries are looking into CBDCs.

That makes international cooperation absolutely essential, in this area as well as in crypto and indeed decentralised finance.

And I welcome that the G7 has laid down a set of principles for Central Bank Digital Currencies, which we will be sure to follow.

So in closing, the evolutions we’re seeing in the financial system are fast-moving, and represent a whole new ecosystem.

So our regulatory measures, we’re acting, in a way, and thinking in the same way – we need to build a new regulatory ecosystem.

The MiCA regulation and the DLT pilot will bring crypto into the regulatory and supervisory fold.

A digital euro could complement private initiatives in this area.

And meanwhile, we are keeping the growth of decentralised finance under careful review.

This new ecosystem holds both opportunities and risks for financial firms, the financial system and the wider society.

So we need to address the risks if we want to benefit from the opportunities.

But I think all of us here are certain of one thing. The old ways of finance and banking are already being overtaken by new digitalised means and solutions.

Rules and regulations are essential and must be tailor-made to meet this fast evolving and exciting area.