By AML Intelligence Correspondents

IRELAND and South Africa were the centre of major operations this month aimed at taking on the massive West African ‘Black Axe’ cyber-crime and money laundering organisation.

Black Axe and similar groups are responsible for the majority of the world’s cyber-enabled financial fraud as well as other serious crimes, says Interpol which co-ordinated raids in an operation codenamed ‘Jackal.’

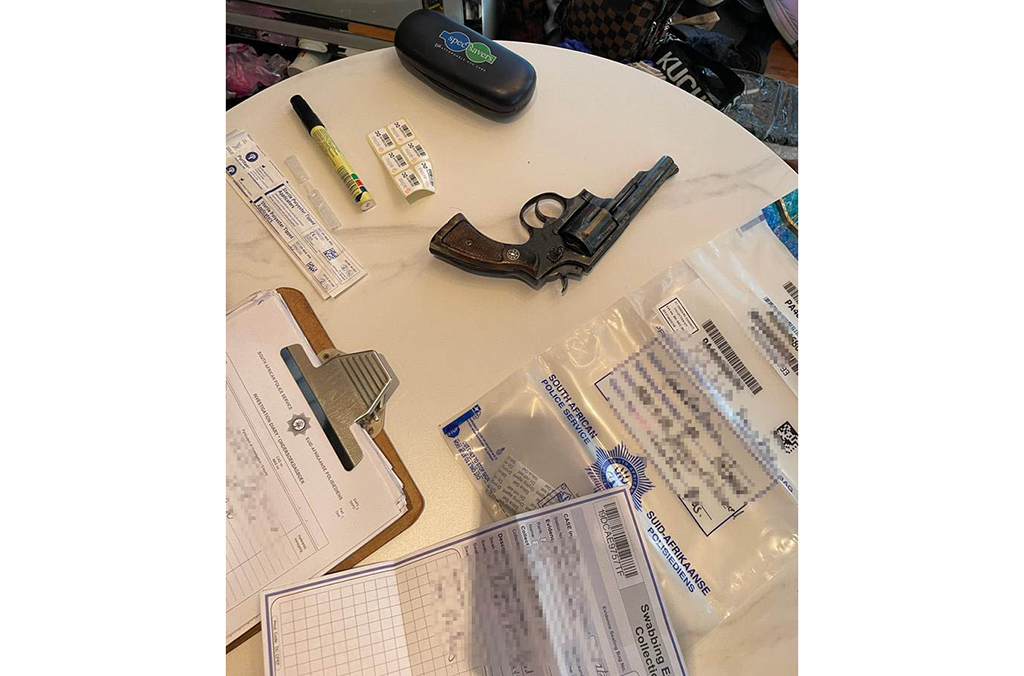

“The lavish lifestyles and greed of many suspects – allegedly paid for by defrauding members of the public of their savings and other criminal activities – was on clear display at the scenes of their arrest,” said an Interpol spokesperson. “Various luxury assets were seized, including a residential property, three cars and tens of thousands in cash.”

The crime group is heavily involved in online fraud, human trafficking, drugs and gun crime, as well as murder.

AML Intelligence can reveal that the operation saw Interpol deploy for the first time its new global stop-payment mechanism known as the Anti-Money Laundering Rapid Response Protocol (ARRP).

The ARRP, currently in its pilot stage, enables police agencies to submit and handle requests to follow, intercept or provisionally freeze illegal proceeds of crime.

Game-changer

The mechanism – first developed with police in South Korea fighting cyber fraud – proved critical to successfully intercepting substantial amounts of illicit funds in several cases throughout ‘Jackal.’

Used within the framework of the agency’s Global Financial Crime Task Force, the ARRP enables member countries to quickly intercept illegal proceeds of crime.

“The ARRP is a game-changer in the fight against global financial crime, where speed and international cooperation are crucial to intercepting illicit funds before they disappear into the pockets of money mules abroad,” said Rory Corcoran, Director of IFCACC.

“Interpol’s Global Financial Crime Task Force has shown remarkable effectiveness in disrupting illicit financial flows, bringing together cyber and finance experts across sectors to track and cut off criminal money trails,” he added.

In total, Operation Jackal resulted in:

- €1.2 million intercepted in bank accounts

- 75 arrests

- 49 property searches

- 7 Interpol Purple Notices, detailing criminal modus operandi

- 6 Interpol Red Notices, issued for internationally-wanted fugitives

In Ireland alone meanwhile, it is estimated more than €64m has been laundered through by international crime gangs, such as the ‘Black Axe’ organisation, according to the national police, An Garda Siochana (AGS) or gardaí.

The Black Axe cartel is blamed for a surge in transnational frauds, such as business invoice and romance fraud.

Operation Jackal comes in the wake of FATF/Interpol (FIRE) summit in Singapore last month, where a new joint initiative to take action against illicit financial flows was launched between the organizations.

Disrupted

Up to $2Trillion in illicit funds are laundered through the global financial system every year, according to the UN. Staggeringly however, it is estimated that just less than 1% of these funds are intercepted and recovered.

“Fraud is transnational, there are no borders,” said Det Supt Michael Cryan of the AGS National Economic Crime Bureau in Dublin who attended the Singapore summit.

Of Operation Jackal, he said: “This is a great example of what can be achieved when international police forces cooperate by sharing intelligence, information and evidence. By working together with support from Interpol, the activities of these criminal gangs can be greatly disrupted, making it safer online for everyone.”

‘Jackal’ was conducted under the aegis of Project CEFIN, which targets cyber-enabled financial crimes and is funded by South Korea.

The full list of participating countries is: Argentina, Australia, Côte d’Ivoire, France, Germany, Ireland, Italy, Malaysia, Nigeria, Spain, South Africa, UAE, UK and US.

This was the first time Interpol coordinated a global operation specifically against the Black Axe cartel, which is seen as rapidly becoming a major security threat worldwide.

The international police agency’s Financial Crime and Anti-Corruption Centre (IFCACC) co-ordinated the operation.

In South Africa alone, the two suspects arrested were wanted for online scams that extracted USD 1.8 million from victims.

In Ireland, the Garda National Economic Crime Bureau said it has identified more than 800 so-called money mules but estimates there are over 4,000 in Ireland.

Many of them have been recruited abroad and flown to Ireland to open accounts to launder millions.

The main operation took place between September 26-30 when officers worldwide launched enforcement operations against individuals linked to the Black Axe group, arresting suspected criminal operators or money mules, raiding and shutting down premises and seizing assets related to ongoing cases. Details were only released this weekend (Saturday, October 15).

Two Interpol operational support teams were also deployed to South Africa and Ireland respectively to help coordinate international law enforcement teams on the ground. In Italy, the Carabinieri made three arrests in Campobasso within the framework of the operation.

“Illicit financial funds are the lifeblood of transnational organized crime, and we have witnessed how groups like Black Axe will channel money gained from online financial scams into other crime areas, such as drugs and human trafficking. These groups demand a global response,” said Stephen Kavanagh, Executive Director of Police Services at Interpol.

Rory Corcoran, the Director of Interpol’s Financial and Organised Crime Unit, was in Dublin to monitor progress of the operation. He said Black Axe was a sophisticated organisation with a business model that involves a division of labour.

Members and associates open bank accounts using false documents in one country, the crime is committed, money is stolen and victims are left in another country while the money is laundered in other countries.

Det Supt Cryan described how the gang’s method of operation keeps changing. Prior to Covid-19, he said, a lot of criminals were flying into Ireland to open bank accounts. However, during the pandemic, they went online and recruited money mules to open bank accounts in their bedroom.

He added that they are now starting to see Irish residents travelling to other countries.

Black Axe had also sent people to Ireland and some have been convicted and jail. They have laundered money, set up front businesses, used false documents and have been in direct contract with the leadership in west Africa.

Meanwhile, police in Ireland warned people not to agree to become money mules. Det Supt Cryan told RTE News: “If you’re a money mule, when you hand over your bank account, it will be used for organised crime.

“You’re the one that will be arrested, it’s your phone number, account, face on CCTV at the ATM.”

He added that the way to tackle the fraud is to stop the money mules and cut off the gangs financial “blood supply”.

IRELAND AND ‘BLACK AXE’

DETECTIVES IN DUBLIN began targeting ‘Black Axe,’ based in West Africa, two years ago.

Their investigation began when they received a request for assistance from another EU country after €1.1m was stolen in a BEC fraud and laundered through Asia.

The fake emails originated in Ireland and indicated that for the first time, the Black Axe criminal organisation was operating in Ireland. The international nature of the crimes necessitated the involvement of Europol in the Hague, Netherlands and Interpol, based out of Lyons, France.

So far, the garda (police) investigation has established that more than €40m has been stolen, with more than €64m laundered through Ireland via money mules.

Separately ‘Operation Skein’ was set up to target romance, business invoice and other fraudster operations in Ireland and has so far resulted in 69 people arrested under organised crime legislation and 195 detained for money laundering offences. A total of 135 of them have been charged.

The operation was led by the Economic Crime Bureau’s commander, Det Chief Supt Pat Lordan.