A year has already passed since the first package of the European Union’s (EU) sanctions against Russia was adopted in response to Russia’s invasion of Ukraine and the war waged in this country.

During the year, nine more packages were approved, the latest of which entered into force most recently. In general, this is a new, unprecedented experience, so it is worth looking back at the progress Latvia has made with regard to the application of sanctions and the main challenges faced.

Scope and impact of sanctions

Since the beginning of the war started by Russia in Ukraine, the EU has imposed sanctions on 1386 natural persons and 171 legal persons, but in reality, the range of persons subject to sanctions is much wider, as not only the persons put on the sanctions lists are subject to sanctions but also other legal persons owned or controlled by the persons subject to sanctions.

In addition, the EU has also imposed wide-scale sectoral sanctions, such as a ban on imports and exports of certain groups of goods or the provision of services, a ban on cooperation with certain persons.

Also, in the financial field, limits for loans to residents of Russia or financial resources held by them have been set.

We can certainly say that the sanctions imposed on Russia are unprecedentedly extensive and were adopted very quickly, taking into account the dynamic escalation of the situation in Ukraine.

These sanctions have a significant impact in Latvia, given the fact that our country borders Russia, and historically Latvia has had and still has relatively close economic relations with this country.

At the same time, the substantial work that has been carried out in the financial sector in Latvia in recent years to reduce the risk exposure of customers – non-residents – should be noted. Thereby, the effects of sanctions in the financial sector are not so remarkable.

Application of sanctions in the focus of supervisors

The role of Latvijas Banka (previously that of the Financial and Capital Market Commission (FCMC)) in the application of sanctions is to ensure that the financial sector implements the necessary control mechanisms for the effective application of sanctions.

Latvijas Banka also issues permits to financial institutions for executing financial transactions of persons subject to sanctions to the extent that it is justified by the exceptions set out in laws and regulations (for example, the provision of basic personal needs, tax payments) and refers to the services provided by financial institutions of Latvia.

It should be noted that particularly in the financial sector, considering the work done in recent years to implement a risk assessment-based approach, considerable experience has been gained, which is an advantage in the field of application of sanctions. Both the scope and significant impact of the sanctions are confirmed by the statistical data on the applications received by the FCMC.

From 1 March 2022 until the end of 2022, 1200 applications and inquiries were received in relation to sanctions, and most of the questions were asked by private sector. Although the number of applications and questions is decreasing, it is still relatively high – on average 30 to 40 applications per month.

The most important challenge is the identification of the state of control of persons subject to sanctions

Financial institutions have developed technical solutions to be able to immediately identify persons subject to sanctions.

In cases where such persons exercise ownership rights or control over the company through an intermediary only, for example, through a chain of several companies or trusted persons, such control can only be identified by performing in-depth investigation measures.

Sanctioned persons often create complex ownership structures deliberately to hide their control.

Therefore, cases of suspicions but no possibility to prove the control of a sanctioned person, are reported to the law enforcement authorities.

Laws and regulations provide for the obligation to immediately freeze the funds of persons subject to sanctions.

From the beginning of the war until 24 February 2023, financial institutions of Latvia had frozen the assets of 35 legal persons and six private individuals totalling 81 million euro. It should be noted that these 35 legal persons are not included in the sanctions lists but are owned or controlled by the sanctioned persons.

The Latvian financial sector has proven its ability to identify not only the persons directly included in the sanctions lists, but also the legal persons owned or controlled by the persons subject to sanctions.

In order to ensure the possibility of identifying the persons owned or controlled by a person subject to sanctions, the Ministry of Justice publishes on the website summarised information on the sanctions applied.

In order to promote a uniform approach, it would be useful to decide on preparing such aggregated information at EU level as well, because experience so far shows that the issue of control may be subject to different interpretations across countries under the same factual conditions.

A single and effective mechanism for the application of sanctions must be established

Until now, a decentralised mechanism for the application of sanctions has been operational in Latvia.

This means that the institutions supervising anti-money laundering also supervise the application of sanctions.

To ensure a uniform approach to the application of sanctions, an informal coordination platform of institutions – the sanctions council – has been established. It provides an opportunity for institutions to exchange experience and harmonise their understanding of issues regarding the application of sanctions.

So far, difficulties observed in practice in relation to ensuring efficient processes refer to cases where it is necessary to decide on the release of funds belonging to a person subject to sanctions and which are necessary for the maintenance of the economic resources of persons subject to sanctions in the cases specified in laws and regulations.

Such situations often demand complex solutions requiring knowledge and experience in various specific areas, which experts of supervisory authorities usually do not have.

For example, it is necessary to understand the costs behind the maintenance and repair of the helicopter to maintain its technical condition or what conditions must be ensured for safe storage of certain chemical substances.

Also, the question arises as to whether the permission to execute certain payments in such cases should be given, for example, by Latvijas Banka, which supervises credit institutions through which the payment is to be executed, or by another institution responsible for registration of aircrafts or supervising the storage of dangerous substances.

It is important to add that decisions have to be taken urgently in many cases to prevent a significant risk of causing damage to the environment and people.

Considering the large volume and impact of sanctions, it would be useful to establish one national institution responsible for sanctions and the issuing of permits to release assets, as well as for the provision of advice to companies and individuals on solving sanction-related issues.

Such a solution would ensure both quick and consistent decision making. The previous sanctions management mechanism was able to ensure its adequate functioning, but the new reality brought about by the protracted war in Ukraine caused by Russia and the ongoing massive application of sanctions requires new solutions for management of sanctions requirements or provisions

Risks of circumventing sanctions are increasing

After the entry into force of the sanctions, Latvijas Banka monitors the flow of payments to the countries that could potentially be used to circumvent the sanctions requirements.

Monitoring data shows a significant drop in payments to and from Russia, but at the same time, the second quarter of 2022 saw an upward trend in payment flows to Central Asian countries such as Kazakhstan and Azerbaijan.

At the same time, Latvia’s export to Russia’s neighbouring countries also grew in the categories of goods included in the sanctions list. This shows increased risks of circumventing sanctions.

Financial institutions also pay attention to sanctions circumvention risks within the framework of transaction monitoring and have identified several typologies of circumventing sanctions.

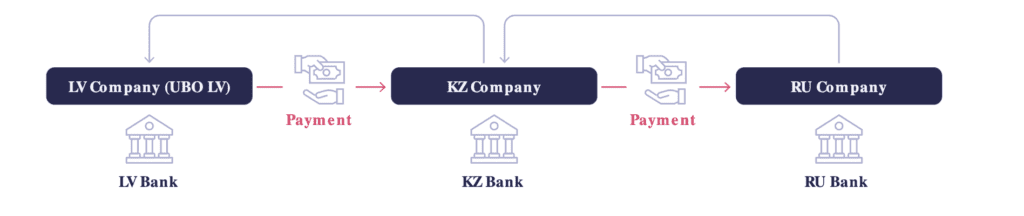

One of these typologies shows that the payment is first transferred to Kazakhstan and then further to a Russian company. In such a scheme, there is a risk that the payment is made to a Russian company under the control of a person subject to sanctions or that the payment is made for goods whose delivery to/from Russia is prohibited.

The use of such a payment chain does not exempt the company from criminal liability if the payment is made for the benefit of a person subject to sanctions or for goods whose delivery to/from Russia is prohibited.

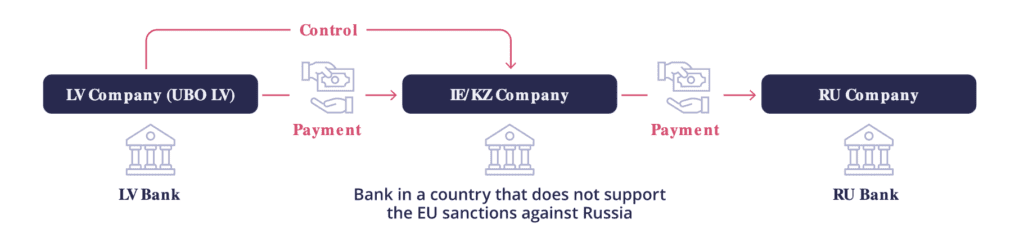

In another typology of circumventing sanctions, a company establishes a new company in a country that does not comply with the EU’s sanctions and makes a payment to that company, then accordingly transfers the funds to Russia.

Even when creating such a payment scheme, there are the same risks of circumventing sanctions, and the use of such a payment scheme also does not exempt the involved persons from criminal liability.

It is important to point out that the compliance with the sanctions is the responsibility of every person and in the case of circumvention of sanctions, the person may be held criminally liable. It is important for companies operating in high-risk segments (production of goods that are included in the list of banned exports) or cooperating with high-risk jurisdictions (countries that do not support the EU’s sanctions) to establish internal control mechanisms ensuring that the company cannot be involved in the circumvention of sanctions.

The risk of circumventing sanctions will certainly remain a challenge in the future as, considering the geographical location of Russia and Latvia, it should be expected that there will be persons trying to use this situation to make money.

The joint task of companies, the financial sector and public institutions is to be aware of this risk and to create control mechanisms that would reduce the possibility of engaging in the circumvention of sanctions.

Share this on:

Follow us on: