The US cryptocurrency enforcement chief has said that the country was stepping up scrutiny of crypto exchanges to target illicit behavior on the platforms.

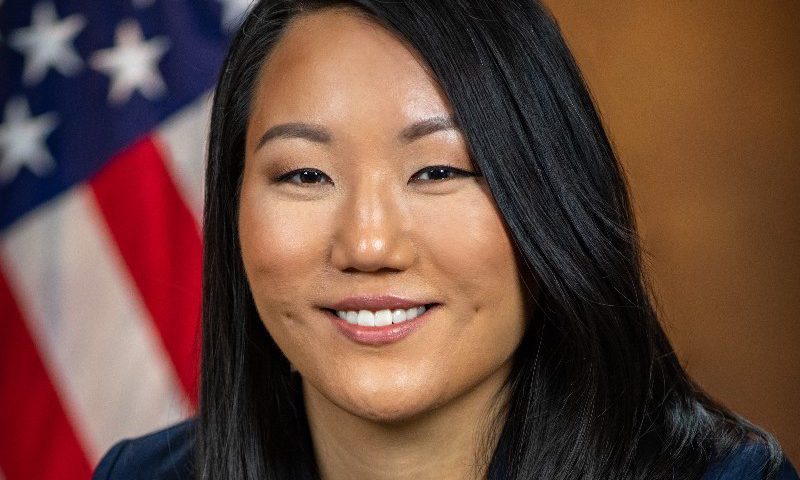

The Department of Justice (DOJ) is targeting crypto companies that engage in crimes themselves or allow crimes like money laundering to happen, Eun Young Choi, director of the agency’s National Cryptocurrency Enforcement Team (NCET), told the FT.

On the target list with crypto exchanges are with the “mixers and tumblers” that obscure the trail of transactions, she said.

“… they’re allowing for all the other criminal actors to easily profit from their crimes and cash out in ways that are obviously problematic to us,” she said.

“And so we hope that by focusing on those types of platforms, we’re going to have a multiplier effect.”

Choi highlighted “pig butchering” schemes, which are named after a Chinese phrase referencing fattening pigs for slaughter, and involve scammers building relationships with victims over the long term.

The justice department last month seized crypto worth more than $112mn linked to such scams.

Choi said the focus on platforms would “send a deterrent message” to businesses that are skirting anti-money laundering or client identification rules, and who were not investing in solid compliance and risk mitigation procedures.

“We’re seeing the scale and the scope of digital assets being used in a variety of illicit ways grow significantly over the last, say, four years,” she said.

“I think that is concurrent with the increase of its adoption by the public writ large.”

If a company “has amassed a significant market share in part because they’re flaunting US criminal law”, the DoJ cannot “be in a position where we give someone a pass because they’re saying ‘Well, now we’ve grown to be too big to fail’”, Choi said.

“Think of what message it would send,” she added. “It can’t be the way that we think when it comes to crypto, when it comes to any white-collar crime.”

The DOJ in March charged Vietnamese national Minh Quoc Nguyen with money laundering and identity theft in connection with crypto platform ChipMixer’s operations, claiming that Nguyen openly flouted financial regulations.

With the novel crackdown on crypto firms, the DOJ aims to ramp up this scrutiny, sending a “deterrent message” to businesses that have been able to avoid anti-money laundering or client identification rules, and who were not investing in solid compliance and risk mitigation procedures, Choi said.

The NCET director, without naming any specific entity, said that a company’s size “is not something that the department will countenance” while weighing potential charges.

The Justice Department will also focus on crimes related to decentralised finance, particularly “chain bridges”, where users can exchange different types of digital tokens, or nascent projects with codes that are vulnerable to such attacks, she added.