By AML Intelligence Correspondents

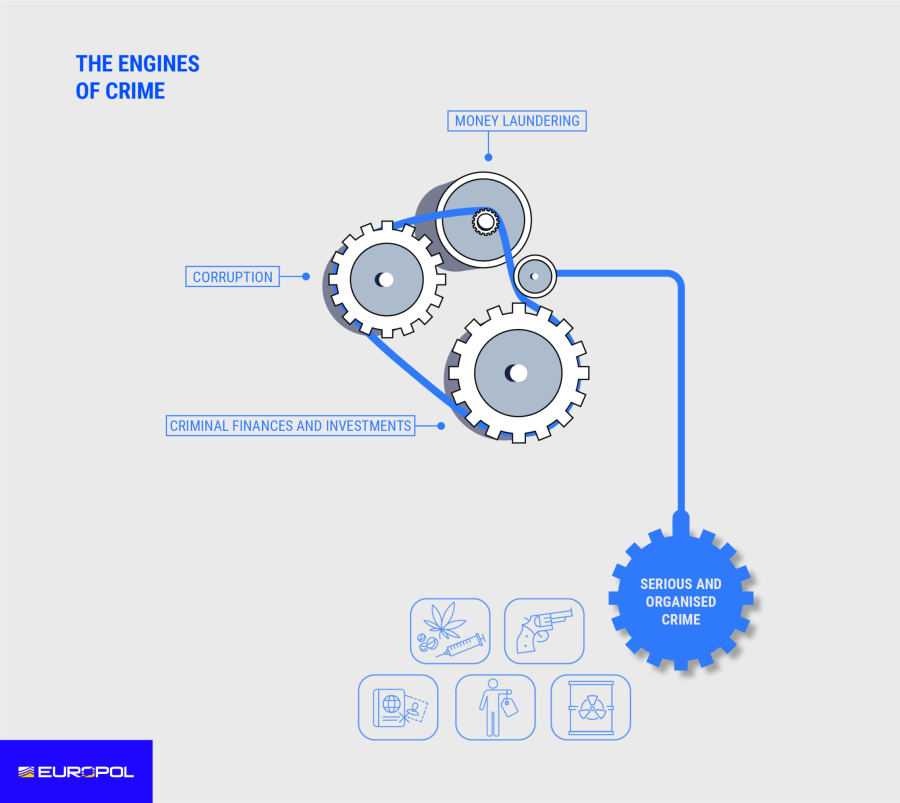

THE GROWING sophistication of money laundering by organised crime in the EU is exposed in a Europol report today (Monday) – which also highlights the bloc’s increasing public and private sector corruption problem.

All new forms of financial services, including fintech, DeFi and vIBANs – as well as Artificial Intelligence – are increasingly being exploited by criminal networks to launder drugs money and commit fraud, says the economic crime report.

Starkly, the report also find that more than 60% of the crime gangs operating in the EU use corruptive methods to achieve their illicit objectives.

It finds almost 70% of criminal networks operating in the EU make use of one form of money laundering or the other to fund their activities and conceal their assets.

The European Union, with its strong economy and high standard of living, is a prime target for serious financial crime, say the agency based in the Hague, Holland.

“Organised crime has built a parallel global criminal economy around money laundering, illicit financial transfers and corruption. With modern technology, they have diversified their modi operandi to evade detection,” warned Europol executive director Catherine De Bolle.

Key findings include:

- 80% of the criminal networks active in the EU misuse legal business structures for criminal activities.

- The criminal landscape in this area is fragmented, with key players often located outside of the EU.

- The techniques and tools used by the criminals advance quickly, as they take advantage of technological and geopolitical developments.

Europol says the best way of tackling the money laundering and corruption pandemic is thru seizing criminal assets. But Europe is way behind in chasing criminal assets. “The amount of captured proceeds still remains too low – below 2% of the yearly estimated proceeds of organised crime,” the authors reveal.

Today’s report is Europol’s first ever threat assessment on the topic. Entitled ‘The other side of the coin: an analysis of financial and economic crime in the EU’, the authors say it “sheds a light on this system which, from the shadows, sustains the finances of criminals worldwide.”

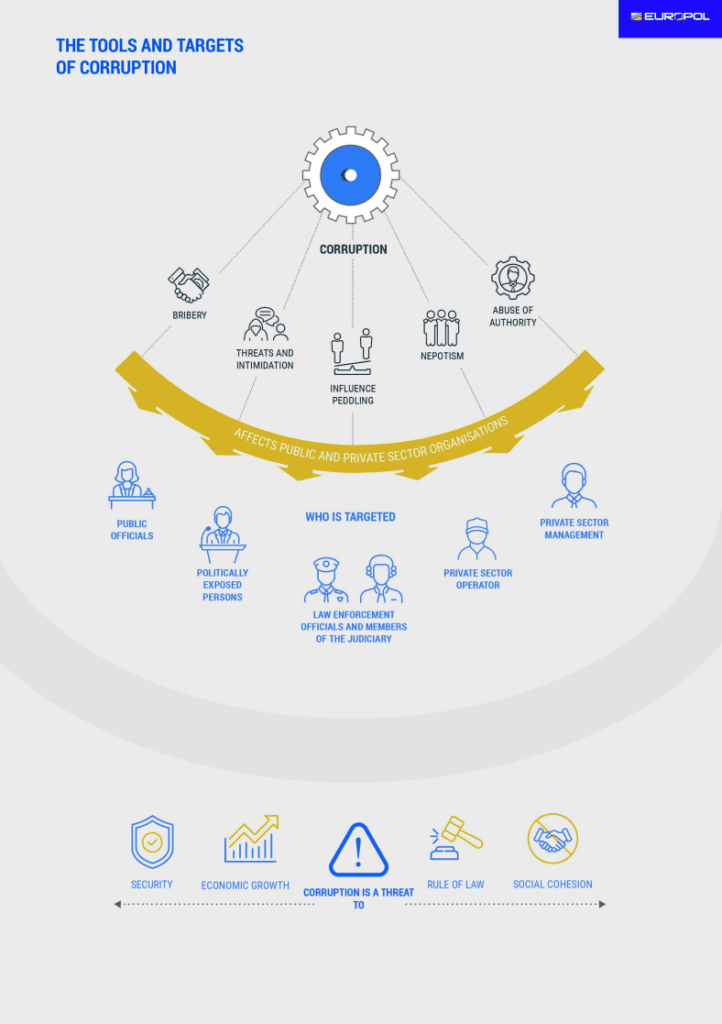

Corruption

Perhaps the most surprising aspect of the report is the EU’s growing corruption creep within its public and private sectors.

Corruption “is an indispensable instrument for organised crime,” it’s found and is globally widespread along all smuggling routes.

“Through corruption, organised crime takes hold of local, regional and national administrations, business entities, and key logistical and transportation hubs.

Criminal networks need multiple points of access to organise the basic operations of their criminal business and to protect them against interventions by law enforcement and judicial authorities.

“Considering corruption as one of the marginal costs of their business, criminal actors build networks of corrupted individuals across multiple organisations and hubs to facilitate their operations and obstruct investigations.

Corruption is used in all steps of criminal activities; corrupted associates in different countries are used for coordinating and enabling the trafficking chain at entry, transit and exit hubs. For example, criminal networks engage in corruption to control critical infrastructure such as ports, to ensure that incoming cocaine shipments are successfully received by criminal customers.

“Police officials, customs officers, security staff, and other personnel at sensitive transportation hubs and at border control points are approached to provide information and ensure trafficked goods can pass unimpaired. Corrupted law enforcement and justice officials also provide sensitive information and influence investigations.

“Some criminal networks may build networks of corrupted individuals in multiple

organisations and hubs, often via multiple channels. In some cases, corruption is

facilitated by independent brokers acting as service providers. The highest bribes

are paid to essential links in the extraction chain, often crane operators, planners or

employees providing access to information via IT systems. Coordinators of extraction teams receive between 7 to 15 % of the value of the illicit load.

“Corruption is sometimes combined with intimidation and threats, or debt bondage, coercion and blackmail, particularly when those corrupted want to end the cooperation.

“Corruption and money laundering are tightly interwoven. This is also true for large-scale corruption, which involves practices such as large payments to bank accounts and offshore companies across different jurisdictions, the use of complex corporate schemes to obfuscate the real beneficiaries, making investments in property or in a country’s economy, and luxury items offered as gifts.

“Corruption involves millions of euros of illicit funds, and corrupted entities use professional criminal networks to help launder the bribes they receive.

“Criminals obscure the source and ownership of funds in corruption schemes, so people receiving bribes can hide their illicit funds and thus make it difficult to detect when corruption is taking place.

“Money laundering investigations are therefore key to revealing corruption schemes. A financial intelligence report or suspicious transactions report from a financial investigation unit (FIU) often leads to a criminal investigation for corruption. These investigations follow money through tangled corporate networks

that link to entities and people that may be either known criminal actors or high-level officials with assets that are not justified by their legitimate activities,” Europol said.

The report is based on a combination of operational insights and strategic intelligence contributed to Europol by EU Member States and Europol’s partners. It analyses all financial and economic crimes affecting the EU, such as money laundering, corruption, fraud, intellectual property crime, and commodity and currency counterfeiting.

Europol chief Catherine de Bolle said: “The report presents Europol’s expertise in financial and economic crimes, detailing how the current threats are manifesting themselves and how these crimes impact the wider society. It serves as a roadmap to foster cooperation that will derail the world of criminal finances, intercept illicit profits, and – above all else – Make Europe Safer,” she said.

The European Commissioner for Home Affairs Ylva Johansson said: “Financial and economic crime, and its scale, is a corrosive force in society.

“Europol and the European Financial and Economic Crime Centre are part of the solution. This report sets out the increasingly sophisticated methods of organised crime and the European law enforcement successes in fighting back. If EU Member States work together even closer on this fight, we can achieve great results,” she added.

Asset recovery as a powerful deterrent

The report finds that asset recovery remains one of the most powerful tools to fight back.

“It deprives criminals of their ill-gotten assets and prevents them from reinvesting them in further crime or integrating them into the mainstream economy.Increasing efforts are being made by EU legislators, Member States and law enforcement to corrode the economic power of serious and organised crime through the recovery of confiscated assets,” the authors say.

“Yet the amount of captured proceeds still remains too low – below 2% of the yearly estimated proceeds of organised crime, according to a data collection carried out on seized assets for the purpose of the report.”

Report Highlights:

“Rapid technological advances in the financial sector have been taken on by criminals as opportunities. Fintech (a portmanteau of ‘financial technology’) integrates technology to improve financial services, which drives innovation, expands financial inclusion and reduces operational costs.

Fintech is now integrated into traditional banking, but also in non-bank and non-financial organisations. Yet, it provides many opportunities for criminal abuse.

Other developments in finance have led to the arrival of digital banking, or neo banks, which are virtual financial institutions with no physical branches. Such banks are increasingly popular, often growing quickly and at the expense of proper compliance processes, which risks disproportionate rates of financial fraud and money laundering offences.

In this context, the use of digital payments for money laundering purposes

has been observed in all Member States, and this practice appears to be growing at

varying rates. Virtual IBANsI (vIBANs) enable fast international payments that mask the identity of the master account, the issuer and country of origin, making it harder to detect suspicious transactions, and adding an extra step to investigations.

The misuse of vIBANs has been observed in recent criminal investigations into various fraud types.

Buy now pay later (BNPL) financing, also known as point-of-sale instalment loans, has also grown recently and criminals have been exploiting current weaknesses in the BNPL application process for theft.

Since BNPL services do not conduct formal credit checks, offenders can often pass the algorithmic checks and use legitimate users’ accounts to illicitly order items. Machine learning, artificial intelligence (AI) and deepfake technology can be used for virtually all types of financial and economic crime.

Chat-bots based on AI, such as ChatGPT, could be easily used in online fraud

schemes5. Deepfake technology can help circumventing remote on-boarding

measures. CEO fraud is a particular risk, as information on high-profile figures at

financial institutions is publicly available.

Decentralised finance (DeFi)II involves using blockchain technology to supplement or replace the traditional centralised financial system. The decentralised blockchain

technology promises greater independence and security, as sensitive information can be protected more robustly.

However, the lack of regulation of this new area leaves openings for economic crime, since criminals hold illicit assets on DeFi platforms. The use of cryptocurrencies for criminal schemes is also increasing in line with their overall

adoption rate (however their criminal use still represents less than one percent of the overall transaction volume).

Offenders appear to be deterred by their high volatility and by some high-profile law enforcement successes in tracing criminal cryptocurrency transactions. However, cryptocurrencies are still largely targeted in fraudulent investment schemes and are also used for a wide range of criminal activities, ranging from trade of illicit goods to fraud and money laundering. Non-fungible tokens (NFTs)

are unique digital identifiers that are recorded in a blockchain.

They have grown significantly in popularity in recent years, and many cryptocurrency exchanges now offer NFTs directly on their platforms. NFTs are frequently abused for fraud: fake NFTs are sold by criminals and legitimate ones are sold multiple times.

NFTs also pose a significant risk of money laundering, due to their instant trading feature across borders.

The metaverse is a set of open and interoperable digital spaces which can be used for many aspects of daily life. The financial sector has been an early adopter, and many actors have established a presence in the metaverse. Criminals will certainly exploit it further as this new virtual environment develops, with cases of fraud, theft, and other crimes already being reported.

The current research into new decentralised web platforms and applications based on peer-to-peer (P2P) interaction rather than on centralised data hosting services could be exploited by organised crime and constitute a further challenge for investigations.

Europol’s European Financial and Economic Crime Centre

The report was produced by the European Financial and Economic Crime Centre (EFECC), founded in June 2020, is Europol’s answer to the growing threats to the economy and integrity of our financial systems.

EFECC’s dedicated specialists and analysts support law enforcement and relevant public authorities in their international financial crime investigations and aims at improving the recovery of criminal assets. In 2022, EFECC supported 402 investigations, with the demand for its skills and services increasing every year.

Share this on:

Follow us on: