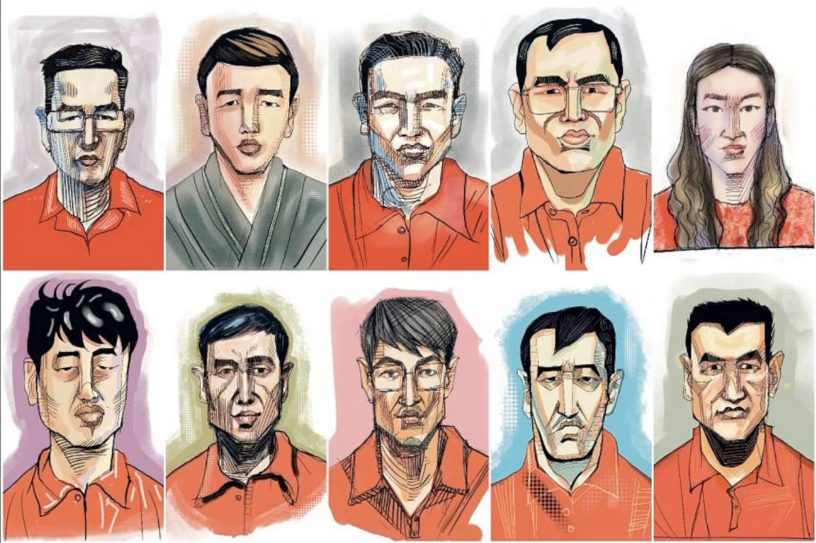

SINGAPORE banks have stepped up scrutiny of customers from a range of countries including China and re-doubling processes to identify the sources of wealth in the wake of the S$2.4bn (US$1.8bn) money-laundering scandal.

Banks are focusing on customers from countries including China, Vanuatu, Turkey, St Kitts and Nevis, Dominica and Cyprus.

The probe has widened to include banks, precious metals dealers, real estate agents and golf clubs. The government has also faced scrutiny about the case and how such lapses happened despite strict AML laws.

Lenders have also told customers the waiting period to open a