By AML Intelligence Correspondents

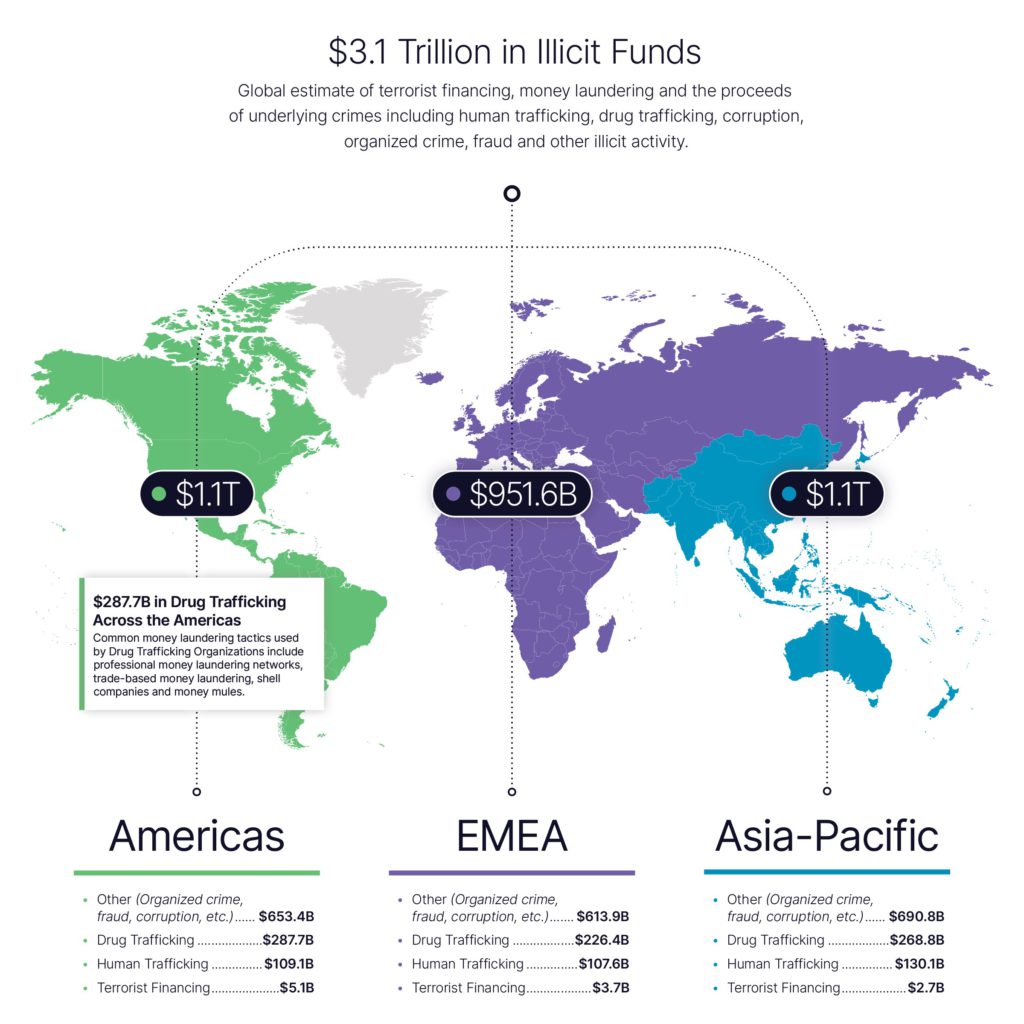

MORE THAN $3 trillion in illicit funds flowed thru the global financial system last year, a new report revealed today.

Among the most prevalent crimes that fuelled $3.1TRN in an illicit flows and money laundering endemic were an estimated:

- $782.9 billion in drug trafficking activity

- $346.7 billion in human trafficking

- $11.5 billion in terrorist financing

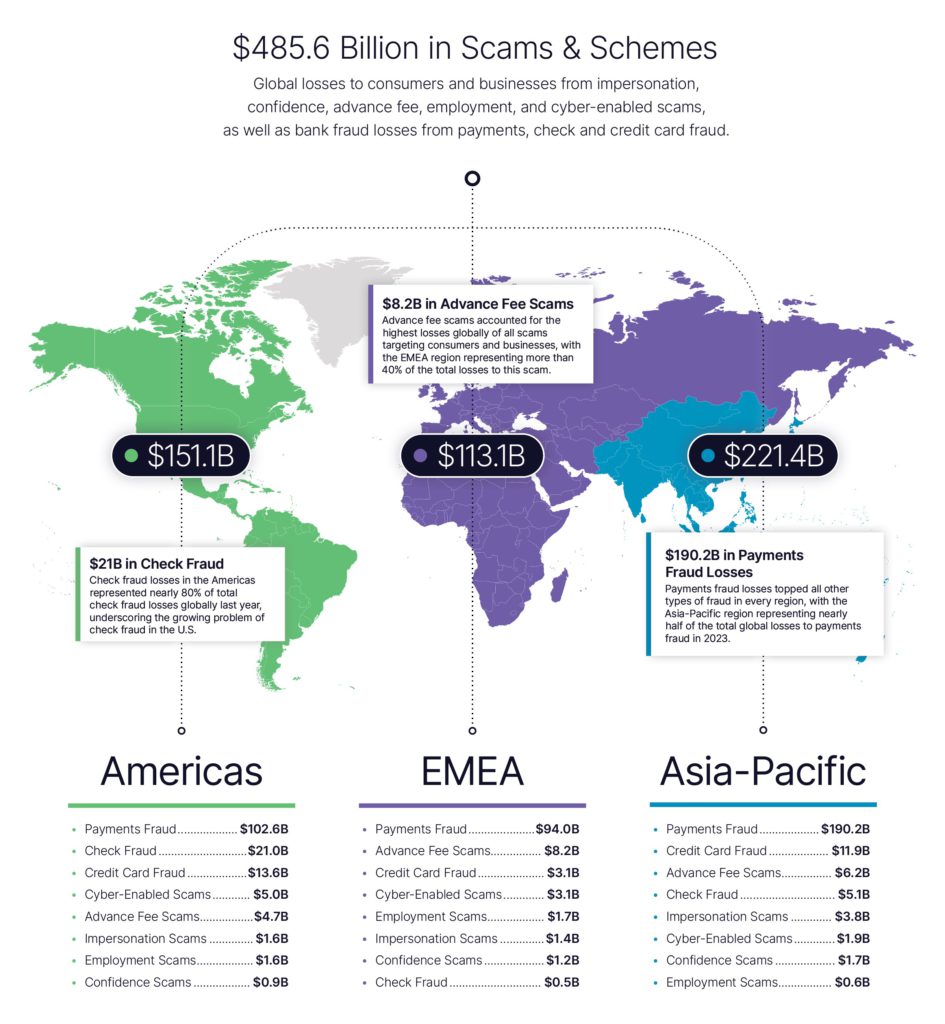

The ‘2024 Global Financial Crime Report’ from Nasdaq-owned fincrime technology firm Verafin also shows that fraud scams and bank fraud schemes totalled $485.6 billion in losses globally.

Nasdaq Chair and CEO Adena Friedman said: “Ultimately, we know that no single company, industry, technology, or government is going to solve the complex problem of financial crime alone. There is an opportunity to work together on a framework and align on measures of success for effective anti-financial crime programs. We all have a responsibility — to ourselves and to the world — to be part of the solution.”

Challenged by increasing operational costs, the inefficiencies of legacy systems and siloed approaches, there has been continuous strain on AFC programs’ efforts to keep pace with new and evolving threats, the report concludes.

“To this end, the industry believes that financial institutions would benefit from more tailored regulatory guidance that elevates financial crime priorities, defines measures of program effectiveness, catalyzes the adoption of artificial intelligence (AI) and technology innovation, and advances information sharing efforts,” it says.

While real-time payments have increased fraud risks, the report also highlights a rise in cheque fraud – particularly in the US.

Of a total of $500 billion in fraud losses, nearly $450 billion in payments, check and credit card fraud. Cheque fraud alone resulted in more than $20 billion in losses in the Americas representing nearly 80pc of total global cheque fraud losses.

Meanwhile, payments fraud represented the highest fraud losses in every region worldwide.

Cyber-Enabled Scams, including Business Email Compromise resulted in $10 billion in losses globally.

Frighteningly, there was nearly $4 billion in losses from Romance Scams and other confidence schemes.

“Financial crime is a multi-trillion-dollar problem, but it has been difficult to measure the full size and scale of it,” said Brendan Brothers, Nasdaq’s Executive Vice President, Anti-Financial Crime and co-founder of Verafin.

“This report is an important step towards understanding the scope of financial crime. By bringing together the numbers, with the perspectives of financial institutions and stories of human impact, we now have a deeply insightful view into the full scope of the problem,” he said.

“Financial institutions are on the front lines of preventing financial crime and protecting customers from harm — but they cannot do it alone. It is why we are at the forefront of bringing the entire ecosystem together to pioneer new ways to address this issue,” he added.

The report surveyed more than 200 anti-financial crime professionals from financial institutions in North America ($10B to $500B+ in assets), and deep dive interviews with several executives.

They saw the Top 4 Threats & Trends as:

o Real-time and faster payments

o Money mule activity

o Terrorist financing

o Drug trafficking

How to stay ahead of emerging threats:

o Communications, alerts, and reports from law enforcement agencies

o Participating in industry-wide initiatives and working groups

o Sharing information directly with other financial institutions

Greatest challenges over next 5-to-10-years:

o Ensuring compliance with regulatory changes and expectations

o Keeping ahead of emerging financial crime risks and threats

o Legacy technology and systems that cannot support our future requirements

o Increasing financial and reputational impact of potential non-compliance

o Lack of regulatory alignment on effectiveness and outcomes-focused programs

Opportunities for Improved Financial Crime Prevention:

o Leveraging data and analytics to identify and prevent financial crime

o Investing in new solutions for financial crime prevention

o Investing in artificial intelligence for financial crime detection

o Collaborating with other financial institutions and industry groups

Areas for Improved Regulation were:

- Typology-specific priorities and guidance (human trafficking, domestic terrorism, etc.)

- Private-to-private collaboration and information sharing (bank-to-bank)

- Encouraging technology innovation (e.g. artificial intelligence and data-driven analytics

- Public-to-private collaboration and information sharing (including feedback loops from law enforcement)

- Incentivizing effectiveness and outcomes-focused programs

The report was based on data collection, research and analysis performed by Celent and Oliver Wyman.

This includes a cross-industry survey of 209 anti-financial crime professionals from bank and nonbank institutions in North America ranging from $10 billion to over $500 billion in assets, as well as deep-dive interviews with senior executives from several global banks.