By AML Intelligence Correspondents

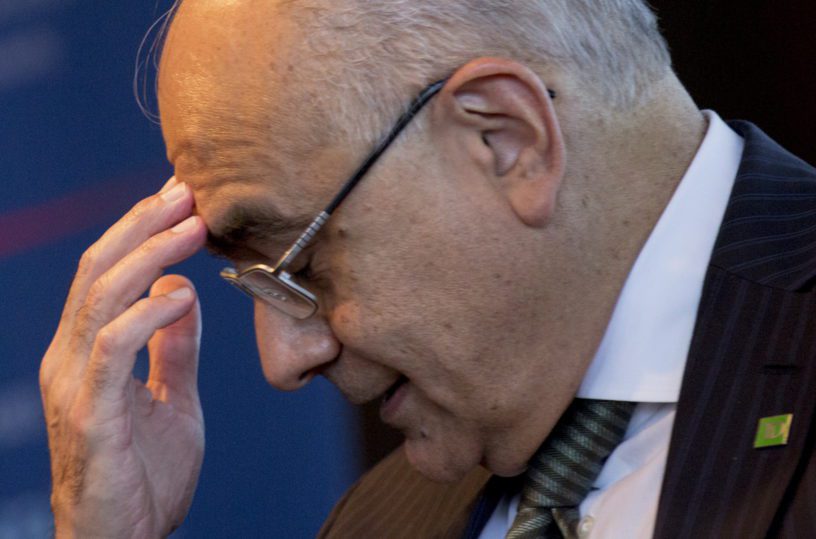

TD Bank CEO Bharat Masrani saw his compensation drop by about 11% to C$13.4 million ($9.93 million) in 2023 – a year marred by the bank’s termination of its First Horizon acquisition and U.S. regulatory issues.

Masrani, who headed TD’s U.S. operations before taking the CEO role, is behind the bank’s ambitious U.S. expansion strategy as it looks for growth opportunities outside of Canada.

The $13 billion First Horizon deal, which would have given TD access to 12 states across the U.S. Southeast, was called off after a long wait for regulatory approvals last year.

The bank shortly afterwards said it was being probed by the U.S. Justice Department about its compliance with anti-money-laundering rules.

“The board believes that the CEO demonstrated excellent personal leadership and performance through a challenging year. However, in acknowledgement of the termination of the First Horizon transaction and certain U.S. regulatory issues, the CEO recommended, and the board approved, the $1 million reduction in compensation,” TD Bank said in a regulatory filing on Tuesday.

The cut stemmed from a 42% fall in non-equity bonus and a 6% drop in share-based awards. The board made no change to the CEO’s total direct compensation target for 2024.

TD said the head of its U.S. retail division Leo Salom also took a pay cut. Salom’s total compensation was down 20.6% in fiscal 2023.

Masrani is the fourth Canadian bank CEO to miss 2023 bonus targets. Of the big five Canadian banks, Royal Bank of Canada chief Dave McKay was the only CEO to exceed his targets, making him the highest-paid bank CEO in the country. In fiscal 2022, Masrani’s total compensation jumped 11.7% and made him the second-highest paid among the five.