By AML Intelligence Correspondent

ALMOST half of financial firms believe current anti-money laundering (AML) regulations are not sufficiently clear or do not address many of the practicalities of modern AML operations, a report today (Wed) said.

Worryingly, many firms – especially banks – having concerns about the workability of both current and upcoming AML regulations.

“Within the EU, such concerns will likely be alleviated moving forward as the new AML Package gets rolled out in the coming years,” the report concludes however.

The results come in a report, covering hundreds of financial institutions in 40 countries across the Europe, the Middle East and Africa (EMEA) region.

PwC’s ‘AML Survey 2024: Spotlight on Effectiveness‘ sheds light on how banks, asset managers, and payment institutions are tackling AML risks, their perspectives on the regulatory environment and future-proofing the financial system.

Financial firms said the biggest challenges are:

- lack of regulatory uniformity;

- finding skilled AML staff;

- data management;

- updating KYC documentation;

- automating processes, and;

- operational costs – increase of 14% in past two years

The most common regulatory concern was lack of uniformity and application across jurisdictions and industries, according to nearly one fifth of respondents, “resulting in ambiguity when it comes to entering relationships and transactions.”

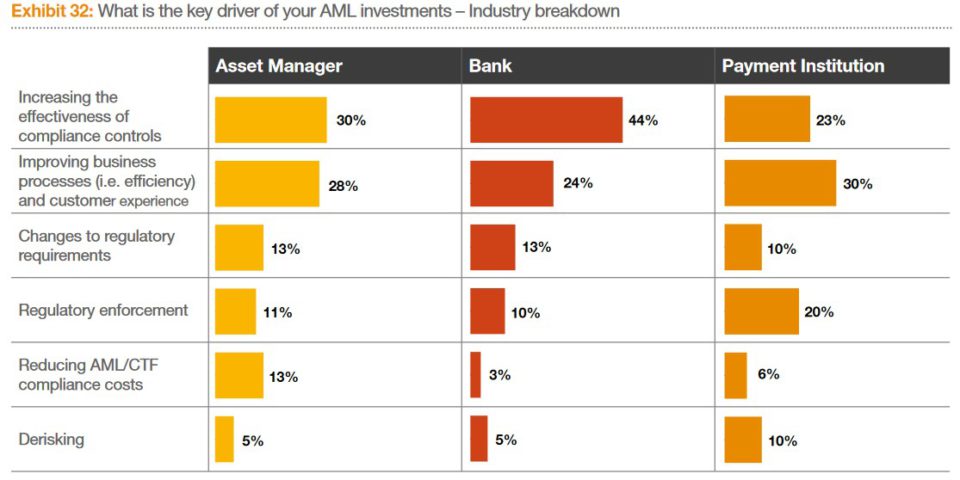

Meanwhile, the main driver behind AML investments is to increase the effectiveness of compliance controls, cited by 36% of respondents, with transaction monitoring being the top AML topic to prioritise.

While all regions are considering implementing AI solutions to their AML operations, financial institutions in the Middle East (93%), Africa (93%), and the Nordics (94%) are the most enthusiastic. Transaction monitoring (79%) and screening (59%) are the main AML functions respondents are planning to use AI for.

Other key findings include:

● Despite the digital hype, having skilled staff is seen as the most important factor for effective AML compliance. For 35% of respondents, this staff-related challenge is also hindering AML teams’ ambitions to implement digital tools which would have otherwise improved their effectiveness by better detecting suspicious activities. Ultimately, without a stable and strong foundation to build on, implementing novel digital tools – AI and otherwise – in AML teams would not bring about the desired improvements in effectiveness and efficiency.

● 63% of respondents are fully confident that their transaction monitoring approach is fit-for-purpose, although 55% say that the maturity of their systems are an impediment to implementing new technologies.

● With regards to digital tools, over half of respondents (55%) expect to spend more than 10% of their AML budget on them, with emerging markets in the Middle East (96%) and Africa (86%) being the most likely to do so than established financial centres. 13% of respondents in the Benelux have no plans to invest in digital tools at all, the highest among all regions under study.

Speaking at the launch of the report, Marilin Pikaro, Director of the Innovation, Conduct and Consumers Department at the European Banking Authority (EBA) said: “Sound AML/CFT governance arrangements, appropriate risk assessment practices, awareness of staff members and timely reporting processes are key to prevent and fight money laundering and terrorist financing (ML/TF).

“The European Banking Authority’s role as defined by its legal mandate is to lead, coordinate and monitor the EU financial sector’s fight against ML/TF across the EU,” she added.

Imran Farooqi, EMEA Anti-Financial Crime Leader at PwC United Kingdom said: “AML frameworks, policies and actions will be a cornerstone of any financial centre that wishes to be seen as a trusted financial hub. Regulatory frameworks have matured considerably over the last decade, however criminals have also been shown to adapt quickly”.

Michael Weis, Anti-Financial Crime Leader at PwC Luxembourg said: “Within the EU financial sector, there’s a mixed sentiment towards regulatory clarity and effectiveness. While just over half of firms see current regulations as clear enough, much scepticism remains about the practicalities of implementation. Despite this, we welcome today the European Parliament’s vote on the EU’s AML package which will address those concerns by helping to create a more harmonised regulatory environment across borders and industries and address some of the operational challenges faced by firms.”