By Paul O’Donoghue

Professionals working in risk, anti-money laundering (AML), information security and finance can learn new details on the threat posed by AI from some of the sector’s leading risk and information security experts from the U.S and Europe later this month at a free webinar later this month.

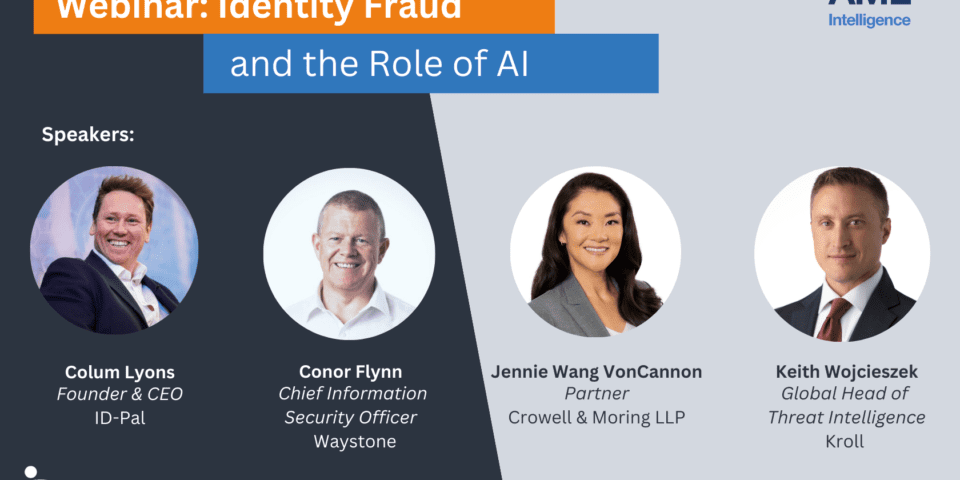

The ‘Identity Fraud and the Role of AI’ event on June 27 is hosted by ID-Pal in association with AML Intelligence, publishers of this site.

On the panel will be former U.S Secret Service Agent Keith Wojcieszek, Global Head of Threat Intelligence at Kroll, one of the world’s largest financial risk and advisory firms. Wojcieszek is a trusted advisor to clients involved in compliance-related or sensitive local and global cybersecurity matters.

Also speaking is Jennie Wang VonCannon (AIGP, CIPP/US), a trial lawyer and Partner in international law firm Crowell & Morell LLP. Wang VonCannon holds over 20 years’ of experience and extensive expertise in corporate defence for both criminal and civil cases, as well as in cybersecurity and intellectual property issue. Having served for over eleven years as a federal prosecutor, it culminated in her serving with distinction as the Deputy Chief of the Cyber and Intellectual Property Crimes Section in California.

While sure to be a fascinating webinar for anyone working in fraud prevention, for U.S professionals in this field it’s particularly relevant, as speakers will discuss the new AI-related rules proposed by the SEC.

The panel is completed with Conor Flynn, is Chief Information Security Officer at global risk and compliance solutions provider Waystone. With over 25 years of Information and Communication Technology (ICT) Security experience, Conor is a pioneer in the field, frequently advising public and private sectors on complex cybersecurity issues.

The moderator for the webinar is ID-Pal Founder and CEO, Colum Lyons. Recently appointed by the Irish Minister of State for Financial Services to the Ireland for Finance Industry Advisory Council (IAC), Colum is also a member of the Technology Council of Ireland and was previously part of the FinTech & Payments Association of Ireland (FPAI). Prior to founding ID-Pal, Colum worked as a Trader and Stockbroker and has over 20 years’ of experience working in the financial markets.

The webinar, hosted by ID-Pal in association with AML Intelligence, will take place on June 27 at 7 pm GMT (ET 2 pm / PT 11 am). Free registration is available here.

This panel’s experts will cover the use of the latest types of AI fraud in client onboarding and the risks AI poses to financial institutions by enabling the production of sophisticated fraudulent documentation at scale.

On the webinar, Colum Lyons shares that the speakers will explore “real case studies highlighting AI’s capabilities and emerging risks”.

“Expect to learn tested strategies for enhancing cybersecurity and compliance, as well as effective approaches to combating identity fraud,” he said.

Lyons adds that financial and compliance professionals who attend the webinar will receive a series of actionable steps allowing them to strengthen their fraud processes.

Keith Wojcieszek comments that while AI can be a powerful tool for fighting cybercrimes and detecting financial irregularities, its use also presents new regulatory challenges, particularly in the U.S. where the reports and instances of AI-fraud have increased dramatically.

“It’s critical to know how AI can be used effectively while navigating new AI-related rules proposed by the SEC,” he said.

“Compliance officers must take proactive steps to manage both the risks and opportunities AI poses to ensure robust protection against identity fraud and privacy issues.”

Share this on:

Follow us on: