By PAUL O’DONOGHUE for AML Intelligence

A group of prominent U.S. official agencies have warned U.S. timeshare owners to be vigilant in detecting and reporting Mexican cartel activity.

The U.S. Treasury’s Office of Foreign Assets Control (OFAC), FinCEN, the Treasury’s AML unit, and the FBI, said in a joint statement that Mexican international cartels “have increasingly targeted U.S. owners of timeshare properties in Mexico”.

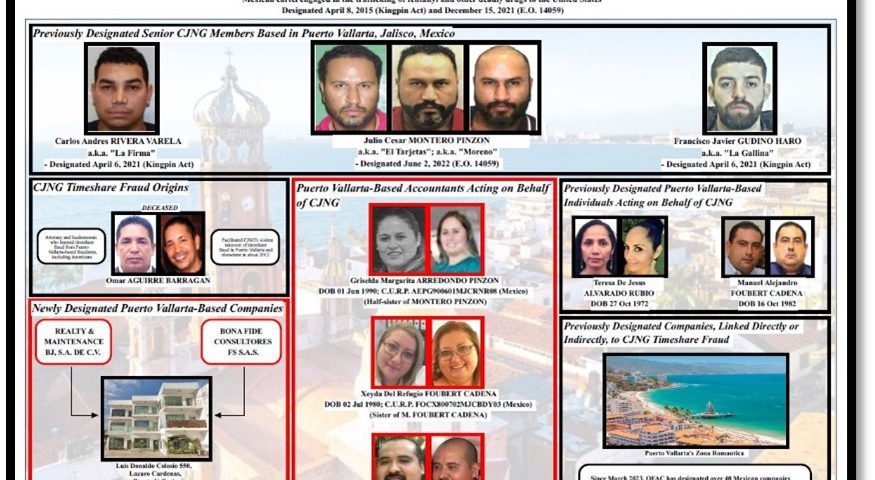

This came as the U.S. also announced that it had sanctioned several accountants linked to the schemes.

“Older adults, including retirees, are frequent victims in these schemes,” the organisations said.

“The [cartels] use proceeds from timeshare fraud to diversify their revenue streams and finance other criminal activities, including the manufacturing and trafficking of illicit fentanyl and other deadly synthetic drugs into the United States.”

Timeshares are homes in which multiple owners hold the right to use the property. Each owner of the same accommodation is typically allotted their period of time at the sites, which tend to be exotic holiday locations.

The notice comes following widespread reports of timeshare fraud involving the Jalisco New Generation Cartel, commonly known as CJNG. The group is reported to have at least two dozen call centres that contact U.S. owners of timeshares with a variety of scams.

Fraud from Mexico-based companies is estimated at hundreds of millions of dollars a year and the Treasury Department has sanctioned 40 Mexican companies associated with the Jalisco cartel and its scams.

The joint statement said that approximately 6,000 U.S. victims have reported losing a total of nearly $300 million between 2019 and 2023 to timeshare fraud schemes in Mexico. However, according to the FBI, this figure likely underestimates the total losses.

“An estimated 80 percent of victims choose not to report the scam due to embarrassment, lack of resources, or other reasons,” the notice said.

The joint statement was published concurrently with a statement from OFAC.

The organisation announced that it has issued sanctions action against three Mexican accountants and four Mexican companies “linked, directly or indirectly, to timeshare fraud led CJNG”.

Further details about the methodologies, financial typologies, and red flag indicators associated with timeshare fraud in Mexico are available here.

U.S. officials urged financial institutions to read this information to help them to identify and report suspicious activity to FinCEN and law enforcement.

FinCEN said that financial institutions with questions about the notice on Mexican timeshares should contact FinCEN’s ‘Regulatory Support Section’ at frc@fincen.gov.