By Dan Byrne for AMLi

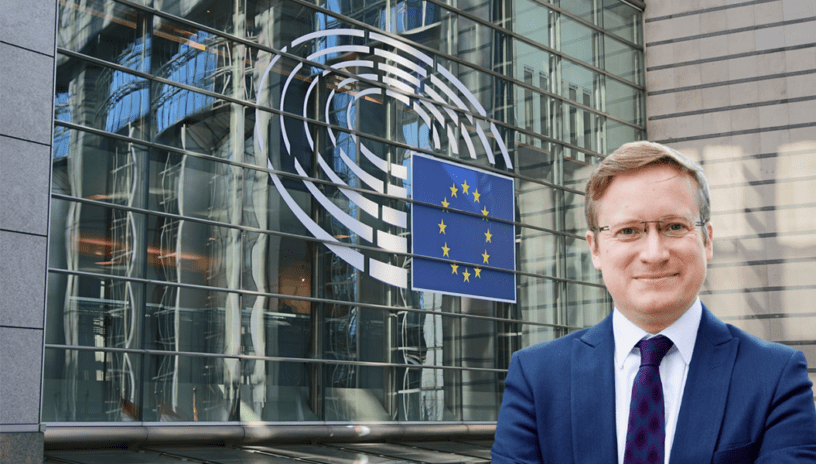

Billions are lost to financial crime in the EU and there are further tasks ahead, according to an MEP and member of the European Parliament committee on Economic and Monetary Affairs (ECON), Ondřej Kovařík

The Czech representative spoke to AMLi on the threat of financial crime in digital finance, which has a growing importance in a trading bloc facing uncertain COVID-19 lockdowns.

“Although the latest EU AML Directive has had its scope extended to include further aspects of digital finance including crypto-assets, personally I think that there is more to be done.” Kovařík said ahead of a European Parliament debate on financial services.

“This includes better information sharing on an EU level, more consistent and harmonised supervision and further examining the risks posed by crypto-assets,” he added.

The Czech MEP was speaking in Parliament Wednesday afternoon on the emerging risks in digital finance, and the challenges that come with regulating and supervising the industry, given the increased threat of financial crime.

His report, on behalf of the Parliamentary committee on Economic and Monetary Affairs, will recommend next steps to the European Commission for addressing these risks, with debate to follow.

“In the report, we devote a sizable portion to dealing with AML/CFT issues which fall under the area of digital finance,” Kovařík explained.

“We call on the commission to take action as regards definitions of ‘virtual assets’ and ‘terrorist financing’, with the aim of ensuring crypto-assets are adequately considered.”

Crypto-assets have frequently been criticised for their avoidance of the scope of some laws which are heavily enforced in other areas of the finance industry.

There have been calls to further integrate cryptocurrency regulations into EU law through strengthening requirements for ‘legal entity’ status and providing more integrated oversight across the bloc.

“We’ve also called on the Commission to extend the scope of obliged entities under the AML framework, in line with the recommendations of ESMA and FATF, to include crypto-assets,” Kovařík explains.

Separately, the report will stress the need for stricter enforcement of know-you-customer (KYC) principles that apply to both EU and non-EU entities which provide services for crypto-asset management.

Blockchain analytics and cryptocurrency intelligence firm CipherTrace claimed that 60% of European service providers have substandard KYC protocols in a report earlier this month – the highest percentage for any continent.

The Financial Services debate takes place at 3pm (Brussels time) alongside a discussion on the Capital Markets Union.

Share this on:

Follow us on: