By AML Intelligence Correspondent

US AUTHORITIES today (Monday) issued a Notice on the use of counterfeit Passport Cards to perpetrate identity theft and fraud schemes at banks.

The Notice provides an overview of the typologies associated with passport card fraud, highlights select red flags to assist financial institutions in identifying and reporting suspicious activity, and reminds financial institutions of their reporting requirements under the Bank Secrecy Act (BSA).

The warning effectively means the days are numbered when FIs can assuredly accept a passport card as proof of identity.

Today’s Notice was issued the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN), in close coordination with the Department of State’s Diplomatic Security Service (DSS).

From 2018 to 2023, U.S. passport card fraud has resulted in $10 million in actual losses and $8 million in additional attempted losses with over 4,000 victims in the United States.

However, DSS and other law enforcement agencies assess losses associated with U.S. passport card fraud and associated identity theft are likely significantly greater and seek increased reporting by financial institutions to identify additional illicit activity.

“FinCEN appreciates our partnership with DSS to highlight what is a concerning increase in the use of U.S. passport cards by illicit actors to impersonate and defraud individuals at financial institutions across the country,” said FinCEN Director Andrea Gacki.

“We are issuing this Notice to help financial institutions and their customers from becoming victims to this crime, and to remind them to remain vigilant in identifying and reporting related suspicious activity,” she said.

Passport cards can be used for travel to Canada, Mexico, the Caribbean and Bermuda. Full book passports are required for other international travel.

The following financial institutions are covered by the Notice:

- Casinos

- Banks/Depository Institutions

- Insurance Industry

- Money Services Businesses

- Mortgage Co/Broker

- Precious Metals/Jewelry Industry

- Securities and Futures

Meanwhile DSS Deputy Assistant Director for the Office of Investigations Greg Batman said: “The Diplomatic Security Service remains committed to protecting the American people and financial institutions from those seeking to perpetrate financial crimes by exploiting Department of State-issued identification documents.”

“We hope this Notice will help financial institutions recognize fraudulent passport cards and their unlawful use.”

Fraud, including financial crimes related to the use of counterfeit U.S. passport cards, is the largest source of illicit proceeds in the United States and represents one of the most significant money laundering threats to the United States, FinCEN said.

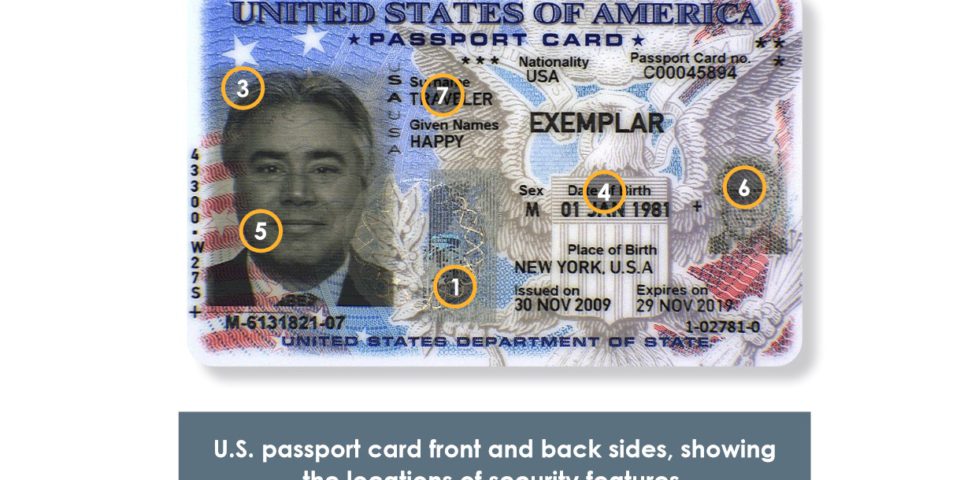

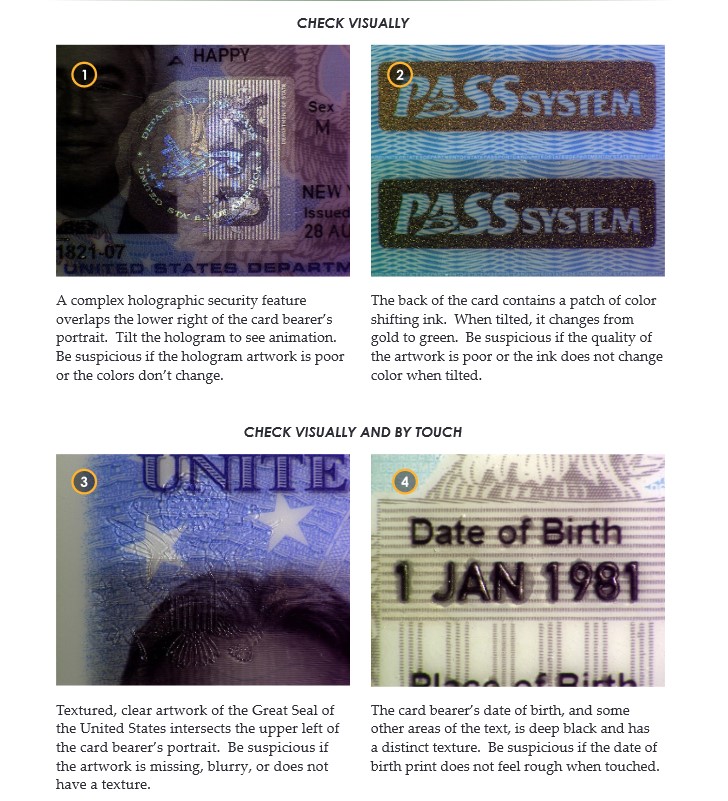

The notice lists 17 technical, behavioral and financial red flags of the typology, including a lack of raised text showing the card bearer’s birthdate and holographic printing of the State Department’s seal, including some detailed here:

Because no single red flag is determinative of illicit or other suspicious activity, financial institutions should consider the surrounding facts and circumstances,

such as:

- a customer’s historical financial activity;

- whether the transactions are in line with prevailing business practices; and

- whether the customer exhibits multiple red flags

before determining if a transaction or attempted transaction is indicative of identity theft and fraud involving a counterfeit passport card or is otherwise suspicious.

Technical Red Flags

- The photo on the presented U.S passport card has a white, blurry border; a dark gray square surrounding the photo; or is in color. Legitimate U.S. passport cards are laser engraved, which produces a clear and crisp grayscale portrait image.

- The photo of the account holder on file does not match the individual present who is pictured in the counterfeit U.S. passport card.

- The card bearer’s date of birth and other areas of text are flat and do not feel raised when touched.

- Legitimate U.S. passport cards have tactile text on certain areas of the card and should feel textured.

- The holographic U.S. Department of State seal is missing or has been substituted with a seal from an unrelated agency.

- The smaller portrait is blurry and does not contain micro-printed text with information specific to the bearer of the card, or the portraits are of different people. On legitimate U.S. passport cards, the secondary photo is a complex image that contains personalized details that are microprinted to create the image

- The signature of a customer presenting a U.S. passport card for identification does not match the customer’s signature card on file.

Behavioral Red Flags

- A customer presenting a U.S. passport card as identification may not know or be able to reference personal identifiers, including date of birth or social security number.

- If a customer presenting a U.S. passport card as identification does know or is able to reference personal identifiers, including date of birth or social security number, they nevertheless lack basic account knowledge and are excessively interested in specific details about their account balances and withdrawal limits.

- A customer appears to be following directions by phone from a third-party.

- A customer presents a U.S. passport card for identification and opens a new joint account with a third-party with whom the customer has no prior relationship.

- A customer conducts transactions characteristic of U.S. passport card fraud at branch locations outside of their geographical footprint.

Financial Red Flags

- A customer presents a U.S. passport card as a form of identification and subsequently withdraws cash, purchases a cashier’s check, purchases money orders, or initiates wire transfers for a large amount for no business or apparent lawful purpose.

- A customer presents a U.S. passport card as a form of identification and attempts to negotiate an uncharacteristic, sudden, or abnormally large volume of checks made payable to cash.

- A customer presents a U.S. passport card as a form of identification, asks for daily withdrawal and transfer limits, and subsequently withdraws cash, initiates a wire transfer, or purchases a cashier’s check made payable to a third party.

- A customer presents a U.S. passport card before transferring funds out of an existing account to a recently established joint account, and the funds are then rapidly withdrawn or wired from the joint account to a separate, unrelated account.

- A customer makes withdrawals from an account at multiple branch locations for no business or apparent lawful purpose using a U.S. passport card as identification.

- A customer engages in behavior that suggests efforts to evade the CTR filing requirements (e.g., the customer alters or cancels a transaction when informed of the CTR filing requirement, or engages in structuring by conducting multiple cash withdrawals below $10,000 during one business day).

The issue of this type of fraud is highlighted in the U.S. Department of the Treasury’s National Money Laundering Risk Assessment, the National Strategy for Combatting Terrorist and Other Illicit Financing, and FinCEN’s Anti-Money Laundering and Countering the Financing of Terrorism National Priorities.

The full Notice is available here: FIN-2024-NTC1.